Paneer Market Share To Rise by USD 22.1 Billion by 2033

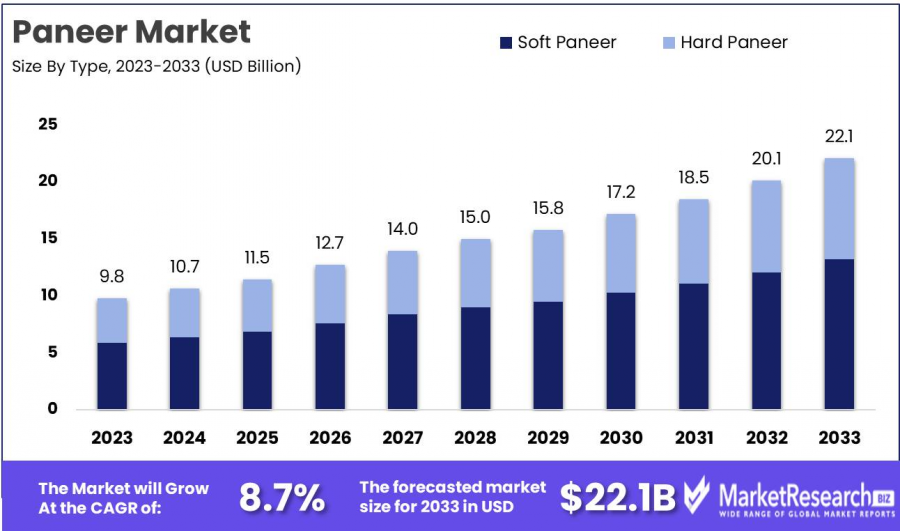

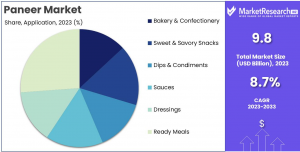

Paneer Market was valued at USD 9.8 Bn in 2023. It is expected to reach USD 22.1 Bn by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

NEW YORK, NY, UNITED STATES, February 5, 2025 /EINPresswire.com/ -- global Paneer Market has emerged as a significant segment within the dairy industry, driven by the increasing demand for protein-rich, vegetarian food products. Paneer, a fresh cheese commonly used in South Asian cuisine, is gaining popularity worldwide due to its versatility, nutritional benefits, and adaptability in various culinary applications. As a rich source of protein, calcium, and essential vitamins, paneer has become a staple in vegetarian diets and is increasingly being incorporated into diverse cuisines, including fusion and Western dishes. The market's growth is further supported by the rising trend of health-conscious consumers seeking natural, minimally processed, and nutrient-dense food options.

This transition is driven by advancements in dairy processing technologies, improved supply chain logistics, and the growing presence of branded paneer products in retail and e-commerce platforms. Major dairy companies are investing in product innovation, packaging, and marketing to cater to the evolving preferences of consumers. Additionally, the market is seeing increased penetration in regions beyond South Asia, including North America, Europe, and the Middle East, where the demand for ethnic and plant-based dairy alternatives is on the rise.

Several driving factors are the growth of the global paneer market. Firstly, the increasing adoption of vegetarian and flexitarian diets, particularly in Western countries, has created a robust demand for paneer as a plant-based protein source. Secondly, the growing awareness of the health benefits associated with paneer, such as its high protein content and low carbohydrate levels, is attracting health-conscious consumers. Thirdly, the expansion of the food service industry, including restaurants, cafes, and fast-food chains, is boosting the consumption of paneer-based dishes. Moreover, the rise of e-commerce platforms and the availability of paneer in convenient, ready-to-cook formats are making it more accessible to a broader audience.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/report/paneer-market/request-sample/

Key Takeaways

• Market Value: The Global Paneer Market was valued at USD 9.8 Bn in 2023. It is expected to reach USD 22.1 Bn by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

• By Type: Soft paneer holds a significant share of the market, accounting for 60% of paneer consumption.

• By Application: Ready meals are the leading application segment for paneer, constituting 30% of its usage across various culinary preparations.

• Regional Dominance: Asia-Pacific, particularly India, dominates the paneer market with a regional share of 70%, owing to high consumption rates in traditional and modern cuisine.

• Growth Opportunity: The paneer market has growth potential by diversifying product offerings to cater to health-conscious consumers and expanding distribution channels in urban and rural areas alike.

Paneer Top Trends

1. Plant-Based Paneer Popularity: With the growing demand for plant-based products, dairy-free paneer alternatives made from soy, almond, and cashew milk are gaining traction. These alternatives cater to vegan, lactose-intolerant, and health-conscious consumers, offering a high-protein, dairy-free substitute for traditional paneer in various dishes.

2. Health-Conscious Consumption: Paneer is being marketed as a healthier protein source, especially in the wake of rising health awareness. Brands are focusing on producing paneer with lower fat content or higher nutritional value, targeting fitness enthusiasts and health-conscious individuals who are looking for cleaner sources of protein.

3. Innovative Paneer Varieties: Traditional paneer is evolving, with new flavors and formats being introduced. Paneer is now available in spiced or flavored variants like tikka, smoked, or even marinated, providing consumers with a diverse range of options for different cuisines and cooking styles, enhancing its versatility in both home kitchens and restaurants.

4. Increased Global Demand: As Indian cuisine gains popularity worldwide, demand for paneer is increasing globally. Countries in North America, Europe, and Southeast Asia are seeing growth in both the retail and food service sectors, driven by the growing influence of Indian culinary traditions and the expanding vegetarian and vegan markets.

5. Sustainability Focus: As sustainability becomes a key concern for consumers, companies are beginning to explore more eco-friendly production methods for paneer. This includes sourcing milk from sustainable farms, reducing packaging waste, and promoting transparency in production processes to meet the ethical and environmental expectations of consumers.

Key Market Segments

Type Analysis

Soft Paneer Dominates the Market: In 2023, Soft Paneer held a dominant 60% share in the market. Known for its smooth texture and moisture content, soft paneer is highly favored for its versatility in dishes like paneer tikka, palak paneer, and paneer butter masala. Its ability to absorb spices and complement rich flavors has made it the preferred choice among consumers seeking creamy textures in their meals.

Hard Paneer Follows: Hard Paneer captured the remaining market share in 2023. It is firmer and drier, making it suitable for grilling, frying, or cubing in dishes like paneer pakora or paneer bhurji. Its longer shelf life and sturdiness during cooking make it ideal for both home cooking and commercial food preparations.

Application Analysis

Ready Meals Lead the Segment: Ready Meals accounted for 30% of paneer production in 2023. These meals, which include paneer as a main or complementary ingredient, are gaining popularity for their convenience and nutritional value. With busy lifestyles, many consumers opt for these time-saving options that don't compromise on taste.

Bakery & Confectionery: Paneer is increasingly being incorporated into bakery and confectionery products, such as cakes and pastries. Its creamy texture and mild flavor enhance the richness of baked goods, adding moisture and flavor. Snacks and Savory Options: Paneer is a popular ingredient in snacks like paneer pakoras, rolls, and sandwiches. These savory options offer satisfying and flavorful snacks, contributing to its growth in the snack food sector.

Key Market Segments List

By Type

• Soft Paneer

• Hard Paneer

By Application

• Bakery & Confectionery

• Sweet & Savory Snacks

• Dips & Condiments

• Sauces

• Dressings

• Ready Meals

Regional Analysis

The Asia-Pacific region holds a 70% share of the global paneer market. The demand is driven by its integral role in South Asian cuisines, particularly in India, Pakistan, and Bangladesh. With established dairy industries and strong consumption traditions, this region remains the largest consumer of paneer. The North American paneer market is expanding, particularly in the U.S. and Canada. The rise of ethnic cuisines and vegetarian diets, along with a strong South Asian diaspora, has led to a steady increase in paneer demand, especially as a protein-rich meat alternative.

In Europe, the paneer market is still emerging, but the increasing popularity of vegetarianism and ethnic cuisines is driving growth. Indian restaurants and cultural festivals contribute to Paneer’s growing presence, while advancements in dairy processing ensure its availability in the market. This region is witnessing moderate growth, fueled by the expansion of the hospitality sector and the growing adoption of vegetarian diets. Paneer is becoming more popular in local cuisines, and restaurants are incorporating paneer-based dishes, enhancing its presence in the market.

Regulations On the Paneer Market

1. Quality Standards for Milk: To ensure high-quality paneer production, many countries set strict standards for the milk used in its production. The milk must meet specific hygiene and safety requirements, including permissible levels of fat, protein, and moisture content. Compliance with these standards helps maintain the consistency and safety of the final paneer product, ensuring it is nutritious and free from contaminants.

2. Food Safety Regulations: Paneer must be produced and stored under sanitary conditions to prevent contamination. Regulations mandate that production facilities follow proper hygiene protocols, including clean equipment, proper storage temperatures, and adequate pest control. These regulations help reduce the risk of foodborne illnesses and ensure the safety of consumers.

3. Labeling Requirements: Paneer products must be labeled accurately to provide clear information about ingredients, nutritional content, and any additives used. The labeling must comply with local regulations, which may require listing the product’s calorie count, fat content, and protein levels. This ensures consumers can make informed decisions about the products they are purchasing.

4. Dairy Product Standards: Paneer is classified under dairy products, and as such, it must adhere to specific national dairy regulations. These may include the permissible levels of fat, moisture, and acidity. Different countries may have varying standards, but the common goal is to maintain consistency in taste, texture, and overall product quality, ensuring consumer trust.

5. Import/Export Regulations: When paneer is traded internationally, it must comply with import/export regulations in both the origin and destination countries. This can include certifications of origin, quality control checks, and specific packaging requirements to preserve freshness. These regulations help ensure that paneer meets the necessary health and safety standards when crossing borders.

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/purchase-report/?report_id=47647

Key Players

• Almarai

• Fonterra

• Calabro Cheese Corporation

• Beijing Sanyuan

• Arla Foods

• HookS Cheese Company

• Sargento Foods

• Groupe Lactalis

• Devondale Murray Goulburn

• Bega Cheese

• Parag Milk Foods

• Brunkow Cheese Factory

• Friesland Campina

• Cady Cheese Factory

• Mother Dairy

• Dupont Cheese

• Arla Foods

• Leprino Foods

• Bongrain

• Burnett Dairy

• Mengniu Dairy

• Bright Dairy

• Inner Mongolia Licheng

• Knight Dairy

• Shandong Tianjiao Biotech.

Conclusion

The Paneer Market is witnessing significant growth, driven by its versatility, nutritional value, and increasing demand for plant-based alternatives. The market is characterized by diverse consumer preferences, with both soft and hard paneer catering to a wide range of culinary applications. Ready meals, snacks, and bakery products featuring paneer are becoming more popular, reflecting changing lifestyles and the growing trend towards convenience. Regionally, Asia-Pacific remains the dominant market, while other regions such as North America and Europe are gradually adopting paneer due to the rise of ethnic and vegetarian diets.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release