- India

- International

Paradise Papers: Appleby records lift veil on rift among stakeholders in Africa mining project

Six years before his death in 2016, mining baron Anil Salgaocar partnered son-in-law Gautam Radia and Malaysian investor Shanmuga Rethenam to enter iron ore sector in Swaziland.

Six years before his death in 2016, mining baron Anil Salgaocar partnered son-in-law Gautam Radia and Malaysian investor Shanmuga Rethenam to enter iron ore sector in Swaziland

Six years before his death in 2016, mining baron Anil Salgaocar partnered son-in-law Gautam Radia and Malaysian investor Shanmuga Rethenam to enter iron ore sector in Swaziland

In 2010, six years before his death, mining baron Anil Salgaocar partnered son-in-law Gautam Radia and Malaysian investor Shanmuga Rethenam to enter iron ore mining in Swaziland, records of offshore legal firm Appleby show.

For the Swaziland venture, Salgaocar set up Eltina Limited in the British Virgin Islands but it ran up huge losses within two years of its operation. Salgaocar passed away in Singapore in 2016 and the project was expropriated. Currently, there is a legal battle on among stakeholders in courts of Swaziland, Canada, France, Seychelles and Singapore — the records do not contain the current status of the legal wrangle.

Records show Shanmuga Rethenam approached Anil Salgaocar through Gautam Radia in 2010 on the availability of iron ore in Swaziland. Within a year of negotiations, the Southern Africa Resources Ltd (formerly Salgaocar Resources Africa Ltd) was formed with Rethenam as sole shareholder “with a view to transfer 80 per cent of the shares” to Salgaocar Asia Pte Ltd (SAPL), a Singapore-incorporated company which is part of the Salgaocar Group.

SG Iron Ore Mining (Pty) Ltd (formerly Salgaocar Swaziland (Pty) Ltd) was incorporated on September 30, 2010 with Southern Africa Resources Ltd holding 50 per cent of shares in SG Iron Ore Mining (Pty) Ltd. Twenty five per cent shares of SG Iron Ore Mining (Pte) Ltd were held by the King of Swaziland and 25 per cent by the Swaziland government. Under the terms, the King of Swaziland was given an advance loan of $10 million.

Also Read | 714 Indians in Paradise Papers

Records show that in March 2012, Gautam Radia arranged for transfer of 80 per cent of the shares in the Southern Africa Resources Ltd to his name and held them in a trust for Anil Salgaocar — Rethenam now held 20 per cent of the shares.

This Swaziland project was for recycling iron dumps of the Ngwenya mine left behind by Anglo American, from which iron ore was extracted, and sold to countries that included China.

Salgaocar’s affidavit in the High Court of Swaziland stated that to commence the Swaziland project, he injected funds through various channels: SAPL to Southern Africa Resources Ltd $800,000 for 80 per cent shareholding in Southern Africa Resources Ltd; SAPL to Southern Africa Resources Ltd — $3000,000 loan for setting up and starting operations of the iron-ore mine in the Kingdom of Swaziland; Eltina Limited to SG Iron Ore Mining (Pte) Ltd — $10,000,000 as advance payment for iron-ore cargo; and, Eltina to Southern Africa Resources Ltd — $ 9,600,000 as loan.

Also Read: Restaurant king Sanjay Chhabra takes Mauritius route to reach India

On April 28, 2011, records show, SG Iron Ore Mining (Pte) Ltd filed an application for a mining licence with the Minerals Management Board (MMB) of the Kingdom of Swaziland. Mining and dispatch of product started on October 21, 2011 to Maputo Port in Mozambique.

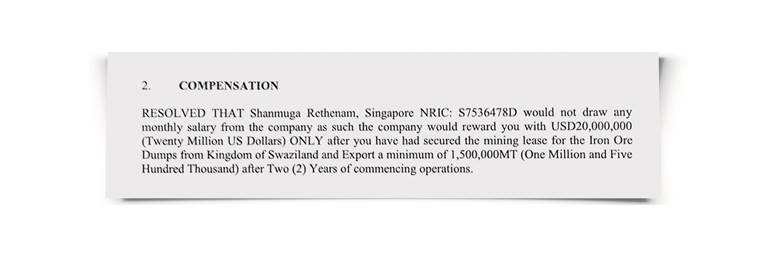

An Appleby document reveals a “reward” for Malaysian investor in Salgaocar project

An Appleby document reveals a “reward” for Malaysian investor in Salgaocar project

In October 2013, Rethenam informed Radia that SARL was in “great financial distress”, that the company had an operating bank balance of less than $0.5 million, and that SARL did not have sufficient funds to pay its creditors. Radia responded to Rethenam in an email, stating he was surprised that the financial position of SARL had deteriorated to such an extent, as SARL had recently posted a profit of over $30 million.

Also Read: Ranjan Pai of Sikkim Manipal University used offshore vehicles to fuel credit

Records show Radia also said that Rethenam owed the company at least $2.6 million due to funds that Rethenam diverted from SARL for personal use or to third-parties. Responding to this, Rethenam said some of the funds diverted from SARL were used for the purpose of refurbishing an aircraft for HMK (King of Swaziland).

Rethenam had appointed Nirmal Rajaram as Chief Financial Officer of SARL. On October 23, 2013, records with Appleby show, Radia sought information on Rajaram’s background as part of his role as SARL chairman. Rethenam responded with an email the same day to both Rajaram and Radia wherein he stated that Rajaram should not respond to Radia’s request for information and recommended that Rajaram resign as CFO. Rajaram did that subsequently.

As the dispute escalated through 2014, records show that Rethenam attempted to isolate Radia from the business affairs of SARL.

Radia attempted to obtain SARL’s financial information from the company’s accountant, PricewaterhouseCoopers LLP, Singapore. PWC did not provide him the information, saying its engagement was with the company and it took its direction from the SARL management.

EXPLAINED: Why the Paradise Papers matter

Records show that Salgaocar, too, was not getting along with son-in-law Radia. In an affidavit, filed in the High Court of Swaziland in November 2014, Salgaocar said, “Gautam without my knowledge started taking hostile steps against me. Gautam entered into an agreement on or about March 2014 to sell 80 per cent of the shares held by him in trust for me in the 2nd Defendant (Southern Africa Resources Limited) to Shan (Shanmuga Rethenam) who was financed by Glencore International AG. Shan (Rethenam), in anticipation of Glencore International AG financing the purchase of shares from Gautam, went ahead to apply for change of name of the 1st Defendant to SG Iron Ore Mining (Pty) Ltd (from earlier name Salgaocar Swaziland (Pty) Ltd) in April 2014. This proposed change of name came to my knowledge in June 20I4.”

But on March 10, 2014, records with Appleby show, Rethenam and Radia reached an agreement to settle their dispute pursuant to which Rethenam would buy out Radia’s interest in SARL and the Shareholders Agreement would be terminated. In addition, Radia resigned from SARL’s Board of Directors.

At the same time, Rethenam was negotiating a deal with Glencore International to invest in SARL and SG Iron and signed a term sheet with them on March 21, 2014. Rethenam and HMK (King of Swaziland), were banking on this deal to be a life changing event for them, records show. But this deal fell through.

SEE PHOTOS | Paradise Papers: Here are the Indians on the list

In May 2014, Ajay Singhvi became involved in the dispute. Described as a mutual friend of both Radia and Rethenam, Singhvi offered to act as an informal mediator. Both Radia and Rethenam agreed. As part of that process, on June 25, 2014, Radia and Rethenam transferred their shares in SARL to AWMPL or Ace Worldwide Management Pte Ltd, with 80 per cent of the shares to be held in a trust for Radia and 20 per cent in a trust for Rethenam.

AWMPL was to hold the shares in trust until such time that the dispute could be settled. At the same time, Ajay Singhvi was appointed CEO of SARL to SARL’s Board of Directors in June 2014 and Rajaram resigned as Director. By then, SARL and SG Iron were in financial distress, which strained Rethenam’s relationship with HMK (King of Swaziland), records show. Rethenam fell ill and even agreed to sell his house in Singapore and his Bentley car to inject funds into SARL, records show. He did sell the Bentley, not the house.

On August 21, 2014, the Swaziland government issued an order that no more iron ore should be sold. In January 2015, the SARL sent a notice for arbitration before the World Bank’s ICSID, requesting compensation of more than $141,000,000, plus other damages and interest.

Full response:

Gautam Radia, Sameer Salgaocar (son of late Anil Salgaocar), Shanmuga Rethenam, Ajay Singhvi and the Government of Swaziland were approached for comments. Only Radia and Singhvi responded.

Gautam Radia: “I was a shareholder of Southern Africa Resources Limited, Seychelles (SARL) along with Mr Shanmuga Rethenam (“Mr Rethenam”), a citizen of Singapore. I purchased my shares from Mr Rethenam directly and paid for these using my savings bank account in India. At all times during which I was a shareholder, Mr Rethenam and I were the only two Directors and the only two shareholders of SARL. I was a Non-Executive Director of SARL, Mr Rethenam was Director and President. SARL ceased doing business in Quarter 3 of 2014. I sold all my shares in SARL in December 2014 and remittance from the sale of these SARL shares was received in my Indian bank account.

Seychelles was chosen as the domicile base for the Africa operations because of its proximity to Mozambique and Swaziland. As you are aware, Swaziland is land-locked and the logistics business of SARL required operations in Mozambique, Swaziland and Singapore.

I was not a Director of SG Iron (Proprietary) Limited, Swaziland at any time. I was not a Shareholder of SG Iron (Proprietary) Limited, Swaziland (“SG Iron”) at any time. Mr Rethenam was Executive Chairman and President of SG Iron from inception until liquidation. Mr Rethenam had special veto rights granted to him by the Kingdom of Swaziland. SG Iron was not permitted to undertake any excavation of minerals from the ground. The lease was restricted to above ground dump clearance. These dumps only contained mining rejects accumulated when the mining operations were conducted from 1960’s until 1983 when the mine was permanently shutdown. SARL owned 50% of SG Iron. A Liquidator was appointed by the High Court of Swaziland to liquidate SG Iron in October 2014. The company’s liquidation was completed in February 2015 by an Order of the High Court of Swaziland. The crash in the prices of iron-ore in the period March 2014 till October 2014 killed the future business prospects of SG Iron. The prices for SG Iron’s product crashed about 50% in 5 months which led to SG Iron’s liquidation.

I was not a Director of Eltina Limited. I was not a Shareholder of Eltina Limited. The only shareholder and director of Eltina Limited was Non-Resident Indian/s. I have had no interests in Eltina. So far as I know, Eltina purchased low grade iron-ore from SG Iron and sold it onward into China.

I was not a Director or a Shareholder of Salgaocar Asia Pte Ltd, Singapore. I was not a Shareholder of Salgaocar Asia Pte Ltd. I have had no interests in Salgaocar Asia Pte Ltd, Singapore.”

Ajay Singhvi: “I am a friend of Mr Gautam Radia and had met Mr Shanmuga Rethenam a couple of times since 2011. When the two of them had differences and problems had escalated to a point of breaking in SARL, I was parachuted in to try and help manage the company and resolve the differences. I got involved with SARL in June 2014 and was appointed co-CEO and Director of SARL on June 24, 2014. One of the main reasons for the precarious condition of the company was when Mr Rethenam’s efforts to get Glencore to invest in SARL failed in May/June 2014. Mr Rethenam then introduced me to multiple investors to try and raise funds for the company. In the meantime, in June 2014, Mr Radia had started arbitration proceedings against Mr Rethenam. In addition, Mr Rethenam wanted his “SG” name in the companies so we decided to rename the companies to SG Iron and Southern Africa Resources Limited. I resigned as CEO of SARL on September 4, 2014. On December 8, 2014 I acquired 80% shareholding in SARL from Mr Radia because there were liquidation proceedings going on in Swaziland and I truly believed that SARL would be able to recover some of the money from the liquidation and that would give me a decent return on my investment.

I am in no way related to and/or associated with SAPL and Eltina. SARL had 50% shareholding in SG iron Ore. However, I was never a Director or Shareholder of SG Iron.

I am not at all involved with Eltina. From what I know, Eltina was not involved as a shareholder or in the management of the Swaziland project. SG Iron managed the operations in Swaziland. SARL managed the logistics for iron ore of SG Iron operating from Mozambique, Swaziland and Singapore. As far as I am aware, Mr Darshan Jhaveri, an NRI based out of Hong Kong and Singapore is the owner of Eltina and Eltina had a long-term contract to buy Iron Ore from SARL and SG Iron Ore.

I am not in dispute with these gentlemen as a group (Radia, Rethenam and King of Swaziland). On January 22, 2015 Mr Rethenam had sent a notice of arbitration to bring a claim under ICSID (part of the World Bank Group) to the Kingdom of Swaziland. This was done by Mr Rethenam without a Board meeting and without proper board consent of SARL. At that time, SARL did not have money to pay lawyers. There was no further action taken with regards to this matter, and arbitration proceedings were never instituted.

My dispute with Mr Rethenam was in 2014 in the Seychelles with regards to the constituency of the Board of SARL. However, that matter no longer exists since SARL itself has been struck off by the Financial Services Authority of the Seychelles.

In 2015, the late Mr Anil Salgaocar filed a case in the Seychelles with respect to the validity of the ownership of shares of SARL. However, that matter never progressed any further and in other separate international litigation proceedings where both Mr Rethenam and Mr Radia were involved, Mr Salgaocar’s allegations were rejected.

In early 2015 on behalf of SARL, I had to intervene in a dispute between Mr Rethenam’s SG Air Leasing and the King’s corporate entity Inchatsavane Company (P) Ltd in the Canadian Supreme Court. The issue was with regards to reimbursement of costs to SG Air for refurbishment of an Aircraft (Case File No. CV-14-519022). The reason SARL intervened was because Mr Rethenam had taken money from SARL in his personal capacity and used it towards the refurbishment of the aircraft, and SG Air did not disclose these facts in the Canadian Courts. I had to protect SARL’s interests.

I am a citizen of the United States of America and was living in the USA till I moved back to India in financial year 2009/2010 to take care of my father. My involvement in these matters you discuss started only in June 2014 with the aim to help two friends solve their issues and to try and help salvage SARL and get it back on its feet. Unfortunately, I was not able to salvage the situation and the last shipment of iron ore from Swaziland/Mozambique was in August 2014. In October 2014, the Kingdom of Swaziland appointed a liquidator to liquidate SG Iron and in April 2017, the Financial Services Authority of the Seychelles moved to strike off SARL from the register of companies in Seychelles.”

Must Read

Apr 23: Latest News

- 01

- 02

- 03

- 04

- 05